What Does The Maplewood Nursing Home Rochester Ny Do?

Wiki Article

The Facts About The Maplewood Rochester Ny Nursing Homes Uncovered

Table of ContentsThe Maplewood Nursing Home In Rochester Ny - The FactsRumored Buzz on The Maplewood Nursing Home In Rochester NyThe Maplewood Nursing Home Rochester Ny Fundamentals ExplainedA Biased View of The Maplewood Nursing Homes Rochester Ny

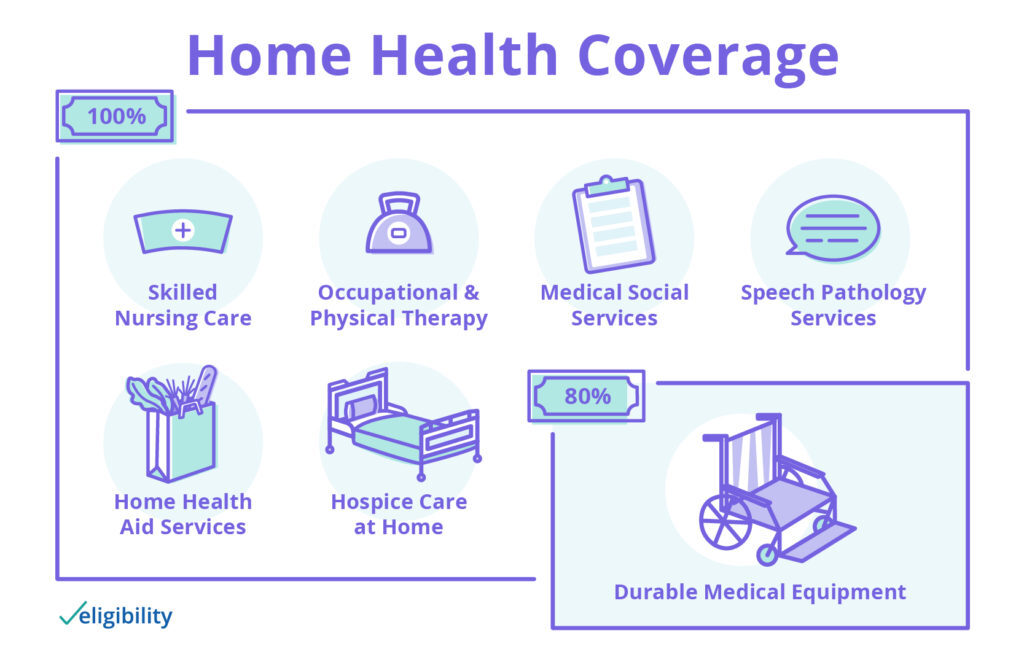

Assets are various than revenue. They are points you possess like your home, cars, as well as stocks that you could develop into money. Several people pay for lasting treatment out of pocket up until they "spend down" their assets enough to be qualified for Medicaid. is a government program that pays for health treatment for people over age 65 and for individuals under age 65 with specials needs.It will certainly cover up to 100 days of treatment in a nursing house after a health center remain. Medicare pays the full price of care for the first 20 days.

This stipulation enables you to obtain your survivor benefit while you live if you're diagnosed with a serious disease. The firm will subtract the amount you obtain for long-lasting care from the death advantage owed to your beneficiaries when you pass away. Long-lasting care insurance spends for numerous kinds of treatment, including: Some policies spend for hospice treatment, break care (treatment to allow pause for family members that are caregivers), treatment after a health center keep, help with house tasks, or caretaker training for relative.

Policies typically do not cover: A pre-existing condition is a disease you obtained medical recommendations or treatment for in the six months prior to the day of insurance coverage. Lasting care policies might delay coverage of a preexisting problem for approximately 6 months after the policy's effective day. Long-lasting care plans don't cover some psychological and also worried conditions, yet they need to cover schizophrenia, major depressive disorders, Alzheimer's disease, as well as other age-related conditions.

An Unbiased View of The Maplewood Rochester Nursing Home

You might need lasting care if persistent or major health problems run in your family members. Ask yourself these inquiries: What are my possessions? Will they transform over the next 10 to twenty years? Are my assets big sufficient to validate the price of a long-lasting care policy? What's my yearly revenue? Will it transform over the following 10 to twenty years? Will I have the ability to afford the policy if my revenue decreases or the costs go up? Exactly how much does the plan expense? Just how a lot will the policy expense if get redirected here I wait up until I'm older to acquire it? Long-term care costs are typically less costly when you're more youthful.

The agent will also tell you the company's long-lasting treatment price increases over the past ten years. Although you can't utilize that to anticipate future rate increases, it can offer you a concept about how much and just how often prices have gone up for that firm. You may be able to deduct component a knockout post of your long-lasting treatment costs from your tax obligations as a medical expenditure.

Facts About The Maplewood Rochester Ny Nursing Homes Uncovered

You usually do not have to declare professional long-term care policy advantages as gross income. If your plan is tax-qualified, it will certainly say so in your plan. Premiums for non-tax-qualified lasting care policies aren't tax-deductible. You could also need to pay tax obligations on any advantages the plan pays that do not pay for treatment.Firms consider your wellness background to choose whether to sell you a policy and also at what cost. More youthful individuals and those with couple of medical concerns usually get lower prices. A company may ask you to answer inquiries about your health or take a medical examination. Respond to all concerns honestly.

A lot of long-lasting treatment insurance policy plans are individual policies. You acquire specific policies straight from insurance policy firms. Some teams provide long-term care policies to their members. Your company may offer a group long-lasting treatment policy to its employees - The Maplewood nursing homes rochester. Team policies hardly ever need a medical examination. Some companies provide coverage to retirees and also family participants.

Insurer need to let you keep your protection after you leave the group or until they cancel the team strategy. You can continue your protection or alter it to another lasting treatment insurance coverage. Federal and U.S (The Maplewood rochester ny nursing homes). Post office workers and senior citizens, active and also retired solution members, and also their dependents can obtain long-lasting treatment insurance policy via the Federal Long-Term Care Insurance Program.

The Maplewood Nursing Home Rochester Ny for Dummies

If you or a relative is a state or public worker or retiree, you could be able to purchase long-term treatment insurance policy under a state federal government program. In Texas, the Teacher Retired life System and also a number of university systems use group strategies. Some organizations provide long-lasting treatment insurance policy to their participants.You generally need to have a medical examination to obtain an association plan. Don't sign up with an organization just to buy an insurance plan. The organization may determine to stop supplying the plan. The Long-Term Care ridgeview nursing home Partnership is a collaboration in between exclusive insurance policy firms, representatives, as well as the state of Texas. It helps Texans fulfill their long-term care requirements.

Attributes include "dollar-for-dollar" property defense, rising cost of living protection, and coverage that follows you to another state if you relocate. Dollar-for-dollar property defense means Medicaid will certainly disregard one buck of your properties for every dollar your policy pays in benefits. This can assist you receive Medicaid also if your properties are above the eligibility limitations.

Report this wiki page